What’s the Difference between Gross and Net Pay: Meaning and Explanation

Content

An employee receives this amount before any taxes or deductions are calculated. This will depend on how you’re paid and whether you receive an annual salary or hourly pay. A salaried employee will be paid a fixed amount, usually divided over 12 months. If you’re being paid by the hour—also sometimes known as a wage employee—your payment will vary depending on the number of hours you work. To calculate gross pay, multiply the hourly rate by the number of hours the employee worked during a pay period. Pre-tax deductions include certain health insurance premiums and 401. Simply put, 401 is a savings and retirement plan that workers contribute to from their wages.

- Any court-ordered garnishment is also subtracted from an employee’s gross pay.

- This isn’t always easy, especially when calculations vary from country to country.

- If that leads to inconclusive results, you can reach out to your company’s HR department and ask exactly what expenses are taken from your pay and how those rates are calculated.

- Employees can consult pay stubs if they have concerns about the difference between gross and net pay.

- Depending on what you owe in taxes or if you have outstanding debts such as student loans or alimony, net incomes per employee will vary, even if they earn the same gross pay.

- Net Salary is the amount of the employee’s salary after deducting tax provident fund and other such deductions from the gross salary, which is generally known as Take home salary.

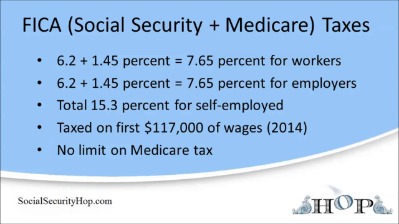

These taxes are also called the Federal Insurance Contribution Act , and according to FICA, employers must match what employees contribute. As an employee, knowing your gross pay is essential as it’s part of your gross income. On the other hand, post-tax deductions are the ones you take out from the amount that remains after pre-tax deductions and taxes. Post-tax deductions typically consist of disability insurance or garnishments. The exact steps to calculate your gross pay will depend on whether you are a salaried or hourly employee. Understanding what your gross and net income is, as well as how much you’ll pay in taxes, can be difficult.

Need Help with Handling the Payroll for Your Business?

You should consult with your own legal, https://intuit-payroll.org/ing, or tax advisors to determine how this general information may apply to your specific circumstances. In other words, FICA taxes are calculated based on a number somewhere between gross and net pay.

What is a net pay?

What is the meaning of net pay? Net pay means take-home pay or the amount employees earn after all payroll deductions are subtracted from their gross pay.

Payroll services, such as ADP, often have net pay calculators on their sites. The W-4, or Employee’s Withholding Certificate, declares the employee’s tax deductions and notes the number of people in their household.

What is gross salary?

This is also sometimes known as your base salary, and excludes any short or long-term incentives or benefits. Net pay is the money left once taxes and deductions have been taken out of your gross pay.

- If you worked any overtime, you’ll multiply the overtime rate by your extra hours and add that number to your regular pay total.

- In the sections below, you can find out not only how gross and net pay relate to each other, but also how to calculate them for your company’s payroll.

- However, your gross income is not the same as your taxable income.

- It is the sum of your wages after taxes and deductions have been removed.

- Whether you receive a fixed annual salary or hourly wages at your job, you may notice two figures on your payslip.

- Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries.

This removes any room for error and legwork you have to do to arrive at a number that may not be entirely correct. To figure out your gross income for a salary position, you just need a recent pay stub and a simple math equation. You build a budget around your net pay instead of gross because it’s a more accurate representation of the money you’ll have available to use in your account every month. When you’re applying for a mortgage, apartment, or any large purchase that requires a loan, they’ll ask for your gross income, as opposed to your net pay.

Differences between Gross Pay and Net Pay

This shows how much you earned in total for the current pay period (which can be weekly, biweekly, monthly, etc.) and year to date. However, these payments are also subject to taxation and are seen as taxable income. So if you pay out a bonus of $1,000, don’t forget to remove the appropriate income tax percentage from the gross pay. Employees and employers work together to make sure the correct amount of taxes and deductions is withdrawn from the employee’s gross income. Employees are required by the IRS to complete Form W-4 where they provide all the important information the employer needs to calculate how much money should be withheld.

The non-exempt employee’s paycheck may also include payments for overtime time,bonuses, reimbursements, and so forth. There’s another type of tax an employer pays, and it’s used for the unemployment benefits program. The Federal Unemployment Tax provides compensation for those who have lost their jobs, and every employer pays 6% on the first $7,000 of each employee’s gross income. However, if you’ve received bonuses or other types of payments from your employer, you may want to calculate your total income manually.

It is the sum of your wages after taxes and deductions have been removed. An employee’s net pay will be more noticeable on their paycheck since this is the total you will receive. Payroll registers show you the total gross wages your business pays during a period.

- An employee’s net wages can be significantly less than their gross wages due to mandatory and voluntary payroll deductions.

- Pay close attention and you should have no problem avoiding payroll headaches .

- Debt can include credit card debit, student loans, alimony, and so on.

- Moreover, Gross Salary involves only compensation benefits to the employee.

- Remember that gross salary can also include other forms of earnings, such as interest payments or bonuses.

So while the The Difference Between Gross Pay And Net Pay salary is a larger figure than your net amount, you will get some of that money back when you retire or access your social security fund. When you prepare payroll for employees, you’ll need both net salary and gross pay on the payslip. Gross pay makes up 100% of the wages, and net pay is what you get after subtracting payroll deductions from gross pay.

The definition of gross pay refers to the salary or hourly rate an employer pays an employee. This amount reflects what the employee earns before any withholdings, such as taxes imposed by any given country. For example, if an employer pays a salary of $70,000 per year to an employee, that $70,000 is the employee’s gross annual income.

Otherwise, your business will likely sink so much time into researching the proper regulations that building a global team could become cost-prohibitive. Accurately calculating gross pay and net pay is critical for your business’s compliance. Fortunately, both net pay and gross pay are fairly simple to calculate. For businesses that are looking to grow and compete at the highest level, global talent is one of the best resources they can tap into. However, when it comes to paying those global employees compliantly, many companies hit roadblocks. A common challenge is understanding net pay and gross pay—what the differences are and how to calculate each in different jurisdictions. After all these taxes and deductions are withheld from your paycheck, you’ll be left with your net pay.