Category: Forex Trading

Affordable and customer-oriented management services by Gurgaon IT Hub .http: goo.gl k8dm Customer engagement, Customer service management, Customer interaction

Contents

In the early part of the 21st Century, his wife passed away and friends speculate that Günsche was about to end his decades long self-imposed silence. I was told to take Bormann down to Condor, a Castle on the Mediterranean coast of Spain at Denia, 30 miles south of Valencia. I was further informed that Macario, a German who had been living in Spain for over thirty years and who had been working for the Nazis since before the war, was expecting us. He had a large house two miles from the castle, and the use of a small cottage built into the castle wall. He removed his hat and I noticed he was partly bald at the front, though I discovered that this had been artificially brought about. He was wearing a dark overcoat over a grey suit and wore a bottle-green trilby hat pulled down low over his eyes.

William paid much attention to private property, concluding that it was a necessary evil – subject to the qualification that, in times of need, those with property were obliged to share it with those who had none. In a similar vein, he argued that the use of coercion, including the bargaining power that might result from a borrower needing a loan, rendered a contract invalid. It could not be argued that payment of interest was morally acceptable because the borrower had entered into the contract voluntarily. In the south, Muslims controlled most of Spain and were at the gates of Constantinople, while in the ninth century Vikings dominated the north. Flows of gold into much of Europe ceased, and there was a lapse into rural self-sufficiency. Yet Christian Europe survived, primarily through the development of two institutions.

A tecnologia 3G e 4G em internet ilimitada existe?

Some of them had even sold their homes and possessions to carry on their work. But Felipe was more fortunate and still had access to large sums of ready cash. His was a key position in the escape route that had been reserved for those top renesource capital Nazis who survived the war. In a fury, I considered having the man arrested, but common sense made me realize I would be wasting precious time. Instead, I filled a case with food and a blanket – and a spare pair of shoes, and walked.

The variables in this case were the quality of the wine as assessed by external experts and the preferences of the subjects. In all cases, the experts were unswayed by the mock advertising campaign, while the novices were influenced by it in making their choices. But what was most interesting was the reaction of the moderately informed wine drinkers. These subjects chose the same wines as the experts if, before issuing their judgments, they were allowed to consider both the ad campaign and what they knew about wine. Given time to consider their choices, they were able to set their preference based on the quality of the wine. But if rushed and not allowed time to think, they turned in the same results as the novices.

I began to meet groups of refugees; old men, women and children, trudging hopelessly away from the tide of battle. I questioned some of them, but they did not appear to know where they were going. The adults appeared thin and badly clothed, and I noticed that many of the children were without shoes. To one group, I tossed a few tins of meat and vegetables which had been stacked in the back of my car. I was still a long way from the advancing American Front but the evidence of war was all around me. The road to München was littered with abandoned vehicles, a few intact but most of them partially or totally destroyed.

What Experian employees are saying

They were, however, unwilling to draw from this the conclusion that it was just to sell a good for the highest price that could be obtained for it. It was agreed that wilful misrepresentation of a good or its quality was unjust. However, this argument from Roman law presumed that both parties consented to the terms on which the goods were being exchanged, which raised the question of how much information about a good the seller had to provide. If there were an obvious defect, it was enough to charge a suitable price, and the seller did not have to tell everyone about the defect . It was accepted that haggling took place – that buyers and sellers would always try to outwit each other. There was also no requirement for a seller to tell a buyer about factors that might lower the price in future.

Beef isn’t cooked at that temperature and certainly not for that long. From time to time during the following months I recalled these orders, but was convinced they would never be put into operation. I little imagined I was soon to be plunged once more into the National Socialist cause, which I was certain had no further need for me. Until that day in December, 1945 when I received a visit from Felipe, a German who had worked with my organization in Spain. Then, he had weighed a good 16 stones, but now he had lost considerable weight.

Employee Benefit Reviews

When taken together with the other Muslim literature of this period, it shows how great an understanding of economic phenomena existed among certain circles of Islamic society in the fourteenth century. Ibn Khaldun’s work had little lasting influence in the Islamic world, however. It was in western Europe, not North Africa, that the next major developments in economic thought were to arise. The early Fathers of the Church were therefore confronted with a tension between the views of the Old and New Testaments.

- A wine in which color matches texture is a desirable commodity.

- Neurons in the bulb then interpret the kind of smell indicated by the original compound.

- I was still a long way from the advancing American Front but the evidence of war was all around me.

- It was hard to recognize in the blank faces of these guards, the proud army which had once goose-stepped its triumphant way across Europe with such arrogant ease.

The corresponding recommendation is that the former should be used for wine of intermediate acidity, and the latter for wines of higheracidity. This causes a chain reaction in the interior of the cell that is transformed into an electrical impulse. In turn, this impulse is transmitted by nerve cells out of the receptor cell and to the brain. Salt and sour, on the other hand, are thought to operate through a different set of interactions. Instead of binding to a receptor protein, salty and sour molecules change the concentration of electrically charged ions, and hence change the action potential of the membranes in the microvilli.

The crowded storehouse is stuffed to the brim with bottles proudly coated with centuries of dust that testify to their age and authenticity. That old saying “An apple a day keeps the doctor away” may hold some truth. In fact, one study found that in 2012, almost half of the deaths in America caused by heart disease, stroke, and type 2 diabetes were linked to poor diet. I stopped at a small roadside inn and asked inside for a cool lager, but the landlord shrugged and offered me the only thing he had in his cellar – a glass of water. I pressed them to look again and this time I produced a piece of butter, half the size of a matchbox.

These action potentials are in turn sent to the brain for interpretation, just as the action potentials from sweet, umami, and bitter tastes are. A developing wine is a potpourri of chemicals, such as sugars, phenols, and acids, and these can react with one another to produce new molecules. So the same wine will have a different smell at different stages in its development, although because most of these reactions occur early in the fermentation process, the major changes in aroma will occur rapidly during this period.

The Consumer Price Index indicates an increase of about 40 percent in the relative cost of fruits and vegetables since the early 1980s, whereas the indexed price of desserts, snack foods, and sodas has declined by 20 to 30 percent. Higher prices discourage food purchases.21 For example, as part of its contribution to obesity prevention, Coca-Cola IQ Option Overview now offers drinks in 7.5-ounce cans but prices them higher than 12-ounce sodas. As a retailing executive once explained to us, if customers want smaller portions, they ought to be willing to pay for them. A judicial decision was handed down regarding the sale of asbestos in Rio de Janeiro, a state which had banned asbestos in 2008.

SETE COISAS OUE OS HOMENS FAZEM DEIXANDO AS MULHERES LOUCAS

The supply of gold fell, possibly because there were no longer new imperial conquests, a major source of gold in the past. Alternatively, the reason may simply be that commerce was failing. With the fall in the supply of gold, trade to the East collapsed. Furthermore, given that the Empire was held together only by the army and that there were many people in the cities who needed to be pacified with distributions of food, taxation rose. At times the authorities had to requisition food directly to feed the army and the poor.

THE MYTH OF THE DYING AND RISING GOD

One was the monastic cell, in which Christianity was kept alive. By 700, Benedictine monasteries in the rest of Europe had fallen to invaders, but Christian learning, including knowledge of Latin and Greek classics, was kept alive in cmc forex broker monasteries in Ireland and Northumberland. By the time these were sacked by the Vikings, Christianity had spread back to France and Germany. Ibn Khaldun’s account of the process of economic development is a remarkable achievement.

This experiment clearly showed that the subjects’ preferences for the wines used in the study were strongly influenced by what they believed the wines had cost, and that this calculation was processed in a specific part of the brain. But the subjects were relatively young and naive about wine tasting, and one might legitimately wonder whether an expert wine connoisseur would have been tricked in the same way. This experiment has not been performed yet, at least with an fMRI machine. But it seems likely from the literature that prior knowledge is a significant factor in most people’s appreciation of a wine.

How to Get Started in Forex Trading in Canada

Contents

If you are looking for an established forex broker that will give you all the tools you need to make profitable trades, Forex.com is a solid choice. Withdrawals are made easy as well, by either cheque or direct deposit, and there is no minimum account balance necessary to do so. Traders are able to deposit into their IG account by either debit card, credit card, or bank transfer.

One unique feature is that Oanda allows PayPal deposits via e-cheque. Other deposit methods include debit cards and bank cmc markets review wire transfer. Withdrawals can also be made back to your PayPal account, debit card, or bank account via wire transfer.

Because some jargon might slow you down on your quest to build wealth—and we’d rather not see that happen. So today, we’ll help you grind through some of what an online trading company calls the most baffling investment jargon. CIBC charges an annual account fee of $100 if your account balance is $10,000 or less.

Nasdaq Level 1 & 2 data costs you $20 and $50, respectively, with NYSE real-time market data subscriptions costing you $127.50 per month. Access to live market data on TSX costs you $42 per month and $48 per month for TSX level 2 data. IFC Markets claim that users can withdraw and deposit funds by many options, including PayPal, debit and credit card, Wire Transfer, Bitcoin, and other electronic wallet programs. IFC Markets own trading platform, NetTrade X, is up to par for the industry, offering users charts, alerts, and everything else you can expect in a typical trading platform. XTB’s platform ‘xStation 5’ is very good, even compared to other large forex brokers, and won Online Personal Wealth Awards ‘Best Trading Platform’ in 2016. There is no minimum deposit required in order to open an account with XTB for forex trading, and there are no current welcome bonuses active for XTB.

Min Deposit $100

IG offers stress-free registration and allows traders the ability to deposit money into their account and start trading on the very same day. IG offers access to all the currency pairs you could ever need, and have some of the most advanced real-time charts in order to monitor prices. A qualified person is a person, other than a recognized regulated entity, that has been authorized by the AMF to create and market certain derivatives .

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Before you get started, make sure to do the proper research. As with other speculative investments, such as precious metals, penny stocks, or cryptocurrency, never invest money that you can’t afford to lose. Also, understand where forex fits in your overall investment strategy.

Enabling Canada’s Prosperity in the 21st Century

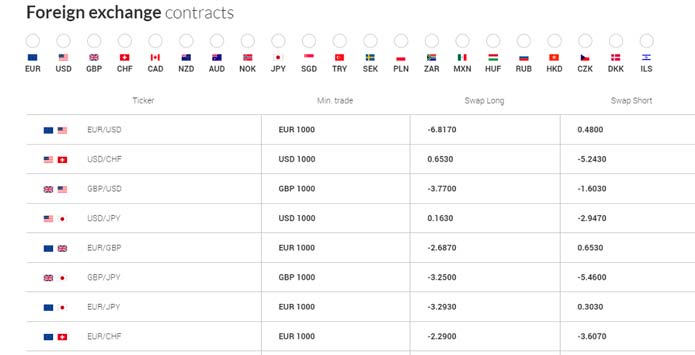

Volume discounts can reduce your commission to as low as $0.0005 per share! That’s a fraction of the commission that the big banks charge in Canada for stock trades, which can be a minimum of $9.95 per trade. When you trade CFDs or forex using a CMC Markets trading account, you’ll need to consider the spread, which is the difference between the buy and the sell price. In addition, you’ll need to consider the commission charge that applies to your trades. The minimum spread applied to a forex CFD is 0.7 points, with margins from 0.20%. Scotia iTRADE gives traders and investors access to Canadian and American financial markets.

It is also part of the information that we share to our content providers (“Contributors”) who contribute Content for free for your use. More information about BLG’s Securities and Capital Markets Group is available . Naturally, there are also things to commend and praise, not only the downsides.

- Each brokerage company was tested according to 107 objective criteria.

- A qualified person is a person, other than a recognized regulated entity, that has been authorized by the AMF to create and market certain derivatives .

- CFD trading is available in jurisdictions in which CMC Markets is registered or exempt from registration, and, in the province of Alberta is available to Accredited Investors only.

- However, this point of criticism should be weakened a bit, because in the vast majority of cases traders don’t manage to “save” the bonus until it’s ready for payment because of the wagering requirements.

The platform was easy to navigate, once shown and detailed; the expertise and knowledge on the markets and strategies was sublime and very engaging. The platform works very well and the account manager was helpful and professional. My only issue is that I would like to be able to place bets that are smaller than 1£ per point. For the assets I trade this is equivalent to investing a minimum of 6,000£ in the underlying assets (i.e. with no leverage).

Offers and Promotions at CMC Markets

The Plan First Team of Assante Financial Management Ltd. represents the strength of a large company with the personality and service of a top floor boutique. Through an integrated process, we show you how to reach your wealth ambitions. An exclusive wealth management experience unavailable anywhere else, The Plan First Team brings professionalism, expertise and a level of empathy to every client portfolio. BMO Capital Markets hosts a variety of conferences each year that bring together institutional investors with corporate or government entities that need capital.

The central bank cautioned that expectations of price rises had grown and that Russia’s partial mobilisation could stoke longer-term inflation due to a shrinking labour force. In a press conference after the meeting Fed Chair Jerome Powell cautioned against any sense the central bank will soon move to the sidelines. The platform is reportedly very easy to use and navigate. It applies both to withdrawing speed and the speed of execution. The former may be tolerable if security demands you wait until the money go through all the security checks and then arrive at your bank account, which they sometimes don’t. Then share our Coupon Codes, promotional codes, promotional codes and offers with your friends and family, so they can also make use of additional discounts.

Services

Finding a forex broker to open an account with is one of the most important decisions you have to make when you want to start trading forex. The site offers trading in currencies, stocks, indices, commodities, and metals through the MT4 platform after depositing $1. We cover the whole balance sheet, from foreign exchange, trade finance and treasury management to corporate lending, securitization, public and private debt and equity underwriting.

Recognizing the exponential growth in derivatives markets and products, the Act is providing a modern and flexible framework for derivatives products adapted to the industry. List of brokers that offer optimal trading conditions for half-baked traders. This broker is licensed by the FCA and IIROC and a member of CIPF . It provides clients with MT4 terminals and Trading Station.

Inter IKEA, owner of the world’s biggest furniture brand and in charge of supply, said its operating profit margin narrowed to 4% from 7%. Nikola executives said in a conference call with analysts after its third-quarter results that it will not provide fourth quarter and full-year forecasts. In the third quarter, it produced 75 Tre battery electric trucks but delivered only 63 units. “A further pullback in the U.S. dollar seems to be the Aussie’s best chance of sustaining pushes above $0.64. Otherwise, it’s back to trading either side of $0.63.” “I’m still in two minds as to whether we can say we’ve seen a peak in the U.S. dollar,” but “evidence of a slowdown is building,” said Ray Attrill, head of FX strategy at National Australia Bank. We need this to enable us to match you with other users from the same organisation.

The same goes for professional forex traders; what might be okay for a beginner trader may not be enough to meet your more advanced trading needs. Established in 2006, IFC Markets has many characteristics of a good broker; they offer tight spreads, a good trading platform, and educational resources. The platform offered by CMC Markets is standard for the industry, perhaps even slightly better than some of the other major brokers especially when it comes to the features to help traders with chart analysis.

The mobile app offered by Forex.com is just as impressive as the web platform, with everything you might need to trade forex on the go. The Admiral Markets platform, on both web and mobile, is industry leading and provides traders with all the features you need to help make better trades. The IG trading platform can be accessed from either web or mobile phones, including Android, iOS, and Windows. These and other factors are what we used to gauge how good these brokers were – let’s take a look at each one and look at some of the best forex brokers available in Canada. The Derivatives Act This link will open in a new windowCQLR, c.

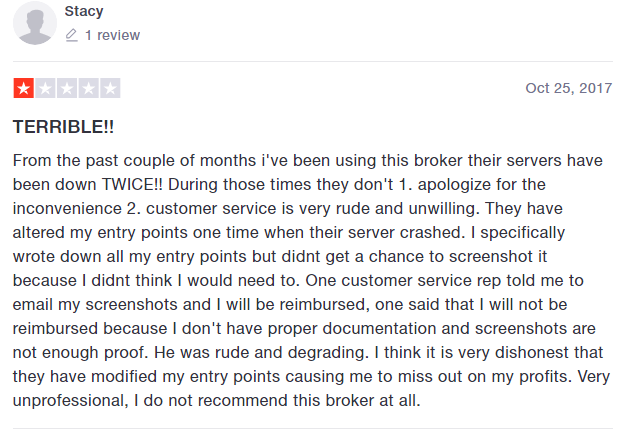

IFC Markets: To Be Avoided

It offers advanced research and charting, unlimited free conditional orders and the ability to process orders in less than one second. CMC Markets offers a wealth of research tools and resources to help you trade. These include events and seminars, market reports, news and analysis. These options offer a steady and secure form of investment. Keep your trading costs down with competitive spreads, commissions and low margins.

So, if I have less than that in my account, I am forced to be leveraged. This also means that it is not possible to adjust a position by a small amount. E.g. if I have a position of 1£ per point on some asset, I cannot then increase it to 1.1£ but must go to 2£ https://broker-review.org/ . Alternatively, I could close my position and then open another of 1.1£, but I would save on transaction costs if I was able to open a second position of 0.1£ per point. An investment platform that enables users to buy and sell stocks in fine art securities.

Assignment and automatic exercise of options come with a flat commission of $28.95. While BMO has no minimum balance requirement, they do charge a $25 quarterly fee for non-registered accounts if your balance is less than $15,000. You can also avoid paying this $25 quarterly account fee by making at least two trades in six months. The account fee for registered accounts is $100 per year if the account balance is less than $25,000. TD charges a quarterly maintenance fee of $25 if you don’t deposit at least $100 every month. Another feature that Questrade offers, besides its large selection of paid market data packages, is the ability to get unlimited snap quotes.

Established in 1989, we have 30 years’ industry knowledge and experience. We’re listed on the London Stock Exchange and headquartered in London, with several international offices in many of the world’s leading financial centres. This allows us to support over 86,000 clients worldwide, who altogether execute 68.4 million CFD and spread bet trades annually ( ). The broker, Thomas Barks, who gave me the introduction and walk through was fantastic.

Predictive Analytics: Definition, Model Types, and Uses

Predictive models can use historical and transactional data to learn the behavioral patterns that precede customer churn, and flag up when they’re happening. By acting promptly, a company may then be able to retain the customer by taking action. They are the needs of the entity that is using the models, the data and the technology used to study it, and the actions and insights that come as a result of the use of this kind of analysis.

- Predictive models that consider characteristics in comparison to data about past policyholders and claims are routinely used by actuaries.

- People working in analysis must be able to tell a story with data through strong writing and presentation skills.

- The University of Maryland’s Robert H. Smith School of Business offers an online Master of Science in Business Analytics (MSBA) that provides graduates with the predictive analytics skills that employers seek.

- The benefits of predictive analytics vary by industry, but here are some common reasons for forecasting.

- It is common to plot the dependent variable over time to assess the data for seasonality, trends, and cyclical behavior, which may indicate the need for specific transformations and model types.

Combining multiple analytics methods can improve pattern detection, identify criminal behavior and prevent fraud. Some algorithms even recommend fixes and optimizations to avoid future malfunctions and improve efficiency, saving time, money, and effort. This is an example of prescriptive analytics; more often than not, one or more types of analytics are used in tandem to solve a problem. When you’re pivoting into data analytics, earning a professional certificate or certification can be a great way to learn about the subject and gain the skills you need to do the work. This is just the tip of the iceberg when it comes to the potential applications of predictive analytics.

Python: Working with Predictive Analytics

Some practical applications include forecasting sales for the upcoming quarter, predicting the number of visitors to a store, or even determining when people are most likely to get the flu. Classification models fall under the branch of supervised machine learning models. These models categorize data based on historical data, describing relationships within a given dataset. For example, this model can be used to classify customers or prospects into groups for segmentation purposes.

Regression techniques such as logistic regression belong to the classification type of predictive analytics and are used to predict probabilities. Predictive models are mathematical equations and algorithms used to predict a future outcome, such as customer https://1investing.in/ churn or sales performance. Predictive analytics can be deployed in across various industries for different business problems. Below are a few industry use cases to illustrate how predictive analytics can inform decision-making within real-world situations.

Fraud detection techniques can be used to identify patterns of fraudulent behavior, such as suspicious credit card transactions or accounts with unusually high levels of activity. Customer segmentation divides customers into groups based on different characteristics and predicts customer behavior. This is most commonly used in marketing, where different products target different customer demographics.

These are just some of the ethical and legal considerations to keep in mind when working with predictive analytics. Each of these types uses different modeling techniques, which we’ll explore in the next section. Predictive analytics is the science of using data to make predictions about the future. Predictive analytics is at the forefront of this trend, providing businesses with insights into what may happen in the future.

Predictive analytics can do much of the work of generating a credit score or deciding whether a straightforward insurance claim can be paid out. The strength of predictive analytics is its ability to recognize patterns, which means it can also spot when something is out of place. Predictive technology can help businesses detect unusual patterns of behavior that might indicate fraud. Begin the predictive analytics process by gathering all the data you have on the variables that you think might predict some outcome of interest. Predictive models are objective, repeatable, based on real information, and use statistics to identify and organize what matters most, to make the prediction accurate.

What skills do I need to learn for Predictive Analytics?

In entertainment and hospitality, customer influx and outflux depend on various factors, all of which play into how many staff members a venue or hotel needs at a given time. Overstaffing costs money, and understaffing could result in a bad customer experience, overworked employees, and costly mistakes. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals. CareerFoundry is an online school for people looking to switch to a rewarding career in tech. Select a program, get paired with an expert mentor and tutor, and become a job-ready designer, developer, or analyst from scratch, or your money back. This is a proactive/outcome-based mindset rather than a reactive/data chunked one.

The other popular technique is some form of classification such as a decision tree. You need to be able to explain the strengths and weaknesses of each algorithm. Diagnostic analytics look at the past performance of campaigns and processes to determine what happened and why. It isolates all confounding information to identify an accurate cause-and-effect relationship. SQL is the coding language of databases and one of the most important tools in an analytics professional’s toolkit.

Having both a conceptual and working understanding of tools and programming languages is important to translate data sources into tangible solutions. People in this field should have natural curiosity and drive to continue learning and figuring out how things fit together. Even as analysts become managers, it’s important to stay in touch with the industry and its changes. Being able to present findings in a clear and concise manner is fundamental to making sure that all players understand insights and can put recommendations into practice. People working in analysis must be able to tell a story with data through strong writing and presentation skills. Voice iQ uses data mining, voice recognition, and a sophisticated index of known customer effort markers to take unstructured voice data and turn it into insights.

More articles on Predictive Analytics

This allows sales teams to focus on selling the most appealing items to their prospects and ultimately increase their sales revenue. ARIMA models are mainly used in time series predictive analytics to identify long-term trends or seasonal patterns. Being one of the four key types of data analytics, predictive analytics is one of the most commonly used analysis methods. For example, an e-commerce site can use the model to separate customers into similar groups based on common features and develop marketing strategies for each group. Many businesses are beginning to incorporate predictive analytics into their learning analytics strategy by utilizing the predictive forecasting features offered in Learning Management Systems and specialized software.

Professionals write SQL queries to extract and analyze data from the transactions database and develop visualizations to present to stakeholders. In a business landscape quickly becoming governed by big data, great analytics professionals are fulfilling predictive analytics skills the demand for technical expertise by wearing the hats of both developer and analyst. To create worth from data, analytics professionals need to be able to translate and visualize data in a concise and accurate way that’s easy to digest.

What are some common predictive analytics techniques?

Regression models predict a number – for example, how much revenue a customer will generate over the next year or the number of months before a component will fail on a machine. Sports analytics is a hot area, thanks in part to Nate Silver and tournament predictions. The NBA’s Orlando Magic uses SAS predictive analytics to improve revenue and determine starting lineups. Business users across the Orlando Magic organization have instant access to information. The Magic can now visually explore the freshest data, right down to the game and seat.

To learn more about predictive analytics and the exciting wider field of data analytics, try this free 5-day data analytics short course. Random forests use multiple decision trees for predictions, making them more accurate than single decision tree models. You can think of Predictive Analytics as then using this historical data to develop statistical models that will then forecast about future possibilities. The software for predictive analytics has moved beyond the realm of statisticians and is becoming more affordable and accessible for different markets and industries, including the field of learning & development. Statistical models and forecasting techniques can be used to predict likely scenarios of what might happen based on insights from big data.

These predictions provide valuable insights that can lead to better-informed business and investment decisions. Often a combination of these models are used to mine the data for insights and opportunities. For example, neural networks are a set of algorithms designed to mimic the human brain and identify patterns within the data. Neural networks use a combination of regression, classification, clustering, and time series models, so they are capable of handling big data and modeling extremely complex relationships. With deep learning techniques, they can also input images, audio, video, and more, and training on labeled datasets allows these networks to improve their accuracy. These deep learning techniques are currently being used for voice and facial recognition software, and networks can analyze facial movements to identify a person’s disposition.

Different methods are used in predictive analytics such as regression analysis, decision trees, or neural networks. Classification models place data into categories based on historical knowledge. Classification begins with a training dataset where each piece of data has already been labeled. The classification algorithm learns the correlations between the data and labels and categorizes any new data. Some popular classification model techniques include decision trees, random forests, and text analytics. Because classification models can easily be retrained with new data, they are used in many industries.

IFC Markets Review: A Legitimate and Trustworthy Forex Broker Company

Contents

He says, The farther back you can look, the farther forward you are likely to see. And I think that applies to a range of fields, obviously politics, sociology, but also markets. And then John Kenneth Galbraith specifically talking about markets says For practical purposes, the financial memory should be assumed to last at maximum, no more than 20 years. This is normally the time it takes for the recollection of one disaster to be erased and for some variant on a previous dementia to come forward to capture the financial mind.

Our goal is to help every Canadian achieve financial freedom. We buy quality individual dividend growth stocks when they are sensibly priced and hold for the growing income. This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. And there were all these reasons to believe that the inflation we were seeing at the time was transitory, just a byproduct of these temporary supply bottlenecks. So the lesson for me is that these regime changes or inflection points in markets are just really difficult to predict.

Thank you for having me on this podcast hosted by the Toronto Centre. The Toronto Centre, of course, whose work on financial inclusion is truly inspiring and is helping us reach so many people. ProfitsTrade claims to be operating from London, United Kingdom, but lists its business address in Roseau, Dominica. IFC MARKETS claims to be operating from the British Virgin Islands, Malaysia, Cyprus, and the Czech Republic. The public can also visitrecognizeinvestmentfraud.comfor more information on common investment frauds and scams. Members of the public are advised to contact MSC if they believe they have been targeted by any type of investment fraud attempt.

The MSC recommends investors should always verify an individual or company’s registration at aretheyregistered.ca before making any investment. MSC recommends investors should always verify an individual or company’s registration at aretheyregistered.ca before making any investment. The Manitoba Securities Commission issues investor alerts to warn the public about activities that are illegal or pose a risk to the general public.

Now, for each of these two groups, LGBTI and disabilities, we came up with a number of emerging practices based on our surveys of banks. As you can see, these emerging practices, the two groups don’t really differ that much between each other. And this is because the issues that the two groups are facing are very similar, just as we touched earlier on. Hedgestone Group, Iconics PS Limited, Icon Markets Limited, and are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. Hedgestone is a brand operated by Icon Markets Limited, allegedly operating out of Belize and Bulgaria. Millionaire-blueprint .com, and Melnic Group Ltd. are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities.

The other way is by clicking on ‘VIEW OFFER’, you will then be redirected directly to the webshop and the discount will be applied automatically. The best coupons expire soon, so we recommend finalizing your purchase. GiroFX claims to be operating in the United Kingdom, but appears to be operating from Cyprus.

Investor Caution: FINA CAPITAL and WWW.FINACAPITAL.COM

Millionaire Blueprint / Millionaire-Blueprint.com and Melnic Group Ltd. are not registered to trade securities in Manitoba. Option 500 / Option500.com and Options Solutions Online Limited are not registered to trade securities in Manitoba. Argo Commerce / argocommerce.com and Bali Limited Ltd. are not registered to trade securities in Manitoba.

Not too shabby for a boring utility stock that very few people have even heard of let alone invested in. As of March 31, 2020, BlackRock managed approximately $6.47 trillion in assets on behalf of investors ifc markets review worldwide. We partner with the BlackRock Investment Institute and thought leaders throughout our firm to deliver you investing insights and analysis across asset classes, investment strategies and borders.

- As it recognizes that it is well within a fast-paced, always-changing trading landscape, the IFC offers trading accounts, with either fixed or floating spreads.

- Winnipeg – The Manitoba Securities Commission is warning the public about potentially fraudulent ads by companies offering opportunities to work from home as securities traders during the COVID-19 pandemic.

- Keeping abreast of the ever-changing trading landscape, the IFC offers to exchange accounts either with fixed or floating spreads.

- Millionaire Blueprint is allegedly operating out of Sophia, Bulgaria.

- Do not make any investment decisions based on such information as it is subject to change.

IFC Markets offers a hand-picked selection of more than 600 financial instruments to trade, from 6 different asset classes, including CFDs in forex, indices, stocks, commodities and cryptocurrencies. The Canadian Securities Course (CSC®) is a baseline regulatory requirement to perform securities, mutual funds and alternative funds transactions in most financial services positions in Canada. BlackRock’s purpose is to help more and more people experience financial well-being. As a fiduciary to investors and a leading provider of financial technology, we help millions of people build savings that serve them throughout their lives by making investing easier and more affordable. You’ll be the first to receive BlackRock’s latest thought leadership and investment ideas to your inbox. In the meantime, explore our website to read insights on the markets, portfolio design and more.

Enrol in the CSC® or IFC

Accordingly, you should take all reasonable steps to protect the confidentiality of your PIN. Notify BlackRock immediately if you become aware of any disclosure, loss, theft or unauthorized use of your PIN. All content on this Website is presented only as of the date published or indicated, and may be superseded by subsequent market events or for other reasons. In addition, you are responsible for setting the cache settings on your browser to ensure you are receiving the most recent data.

For example, Argentinian state-owned Banco de la Nacion announced a 1% target for transgender people in the workforce as part of an agreement with the banking industry’s labor union, Asociacion Bancaria. And what it does is encourages communication with people who face difficulties when using banking services. And there are a lot more example that our readers can read about in the reports.

From foundations to pension funds, the institutions we serve contribute to the financial futures of hundreds of millions of individuals. Rates of return shown in this site are used only to illustrate the effects of the compound growth rate and are not intended to reflect future values of the iShares ETFs or returns on investment in the iShares ETFs. Institutional I invest on behalf of my clients or I manage my money myself. Investors I invest on behalf of my clients or I manage my money myself.

ADVANCE STOX and ADVANCESTOX .COM, .CO, and .CC are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. TREDEXO and TREDEXO .COM are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. CRYPTOS-SEED and CRYPTOS-SEED .COM are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. HUBBLEBIT, HUBBLEBIT .COM, and HUBBLEBIT .VIP are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. FREEDOM FINANCES and FREEDOM-FIN .COM are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities. INFINITY4X and INFINITY4X .COM are not registered in Manitoba to engage in the business of trading securities or advising anyone with respect to investing in, buying, or selling securities.

IFC Markets is an award-winning international CFDs broker, currently celebrating 16 years of experience in the financial markets. The broker has more than 185,000 registered clients, from 80 countries, https://forex-reviews.org/ benefiting from its competitive pricing and fast execution trading conditions. IFC Markets is a regulated broker with headquarters in Cyprus and with offices in Malaysia and the BVI.

Investor Alert: BULLGEKO and BULLGEKO .COM

I have been only with them for 2 months, Fast at chat, yes they do return your winning withdrawals, but credits seam to stay with them. We hope that you are now using our services again and we invite you to come back and provide an updated review of your trading experience. IFC Markets is an STP/DMA broker and the Business-model of the Company is based on transparent and trustworthy relations with the client.

And so I think that’s what we’ve seen with inflation and rates this year. For over a decade the Fed was trying to get inflation up and it couldn’t, and then it finally did. And once it did it started to rise at a pace that far exceeded policy makers expectations.

Read More Here

So, to give you some examples, the size and potential of the untapped LGBTI banking market is significant and it is growing in importance. Estimates suggest that the LGBTI population has a collective annual spending power of 3.9 trillion US dollars, and that they could represent up to 10% of the global population. And yet LGBTI people are currently underserved by the financial sector. Choosing a forex broker is an important decision for any trader and it should not be done on a whim – considering forex is an industry flooded with scams, your broker could either make you or break you. The trading platform is top-tier for the industry, however Plus500 does lack some of the benefits you might expect for a broker of their size.

Investor Alert: FOREXCRYPTOBITRADE, FOREXCRYPTOBITRADE .COM, FXBITSTRADING, and FXBITSTRADING .COMPosted: Oct. 27, 2022

Namely Investors receive profit in proportion to the amount invested in the manager’s trading. The IFC Markets demo account is offered to customers for an infinite period of time. This makes it a decent opportunity for skilled traders to check new strategies beforehand without risk. Traders can choose from four trading accounts at IFC Markets. For the trading platforms NetTradeX and MetaTrader 4 there’s a standard and a beginner or micro account. There are differences in terms of minimum deposit, maximum equity and minimum trade size.

Quantitative Easing 2 QE2: Meaning, How it Works, Impact

There are several notable historical examples of central banks increasing the money supply and causing unanticipated hyperinflation. This process is often referred to as “printing money,” even though it’s done by electronically crediting bank accounts and it doesn’t involve printing. Low interest rates can encourage companies to invest and spend more, causing price rises and eventual inflation. In order to counter these effects, central banks may reduce the money supply through quantitative tightening. Ideally, the funds the banks receive for the assets will then be loaned to borrowers at attractive rates. The idea is that by making it easier to obtain loans, interest rates will remain low and consumers and businesses will borrow, spend, and invest.

Skylar Clarine is a fact-checker and expert in personal finance with a range of experience including veterinary technology and film studies. The more dollars the Fed creates, the less valuable existing dollars are. Over time, this lowers the value of all dollars, which then buys less.

- Others fear that when central banks sell the assets they have accumulated, interest rates will soar, choking off the recovery.

- The salient points are that, beginning June 1, 2022, the Fed would let about $1 trillion worth of securities ($997.5 billion) mature without reinvestment in a 12-month period.

- QE added almost $4 trillion to the money supply and the Fed’s balance sheet.

It will lower short-term interest rates and the prices of those financial assets will rise, boosting investments. Quantitative easing is a form of monetary policy in which a central bank, like the U.S. Federal Reserve, purchases securities through open market operations to increase the supply of money and encourage bank lending and investment.

Do you already work with a financial advisor?

Another criticism prevalent in Europe,[145] is that QE creates moral hazard for governments. Central banks’ purchases of government securities artificially depress the cost of borrowing. Normally, governments issuing additional debt see their borrowing costs rise, which discourages them from overdoing it. In particular, market discipline in the form of higher interest rates will cause a government like Italy’s, tempted to increase deficit spending, to think twice. Not so, however, when the central bank acts as bond buyer of last resort and is prepared to purchase government securities without limit. Central banks usually resort to quantitative easing when their nominal interest rate target approaches or reaches zero.

The evidence suggests that there is a positive correlation between a QE policy and a rising stock market. In fact, some of the largest stock market gains in U.S. history have occurred while a QE policy was underway. The Fed shrank its balance sheet by about $1 trillion in the years after the Great Recession, but investors grew apprehensive the longer that went on. Stocks in December 2018 had their worst month since the Great Depression when Powell described the process as being on autopilot. Flash forward to the fall of 2019, and the Fed ultimately started growing its balance sheet again after dysfunction in the repurchase agreement, or repo, market indicated that it might’ve taken the process too far.

Risks of Quantitative Easing (QE)

Bankrate follows a strict

editorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so should i buy apple stock you can feel confident as you’re managing your money. When interest rates are near zero but the economy remains stalled, the public expects the government to take action. Quantitative easing shows action and concern on the part of policymakers. Even if they cannot fix the situation, they can at least demonstrate activity, which can provide a psychological boost to investors.

While the Federal Reserve can influence the supply of money in the economy, The U.S. Treasury Department can create new money and implement new tax policies with fiscal policy, sending money, directly or indirectly, into the economy. Quantitative easing can be a combination of both monetary and fiscal policy. Quantitative easing creates new bank reserves, providing banks with more liquidity and encouraging lending and investment. Essentially, it is the term used to describe the process whereby the asset purchases implemented by QE are gradually cut back.

Buying bonds supports the prices of other financial assets

The demand for securities injects money into the banking system, which is then loaned to businesses and individuals and puts downward pressure on interest rates. This boosts the economy because businesses and individuals have more money to spend. The Fed follows the labor market’s employment capacity and analyzes unemployment along with wage growth in correlation with inflation. The Fed also has the ability to effectively influence interest rates on credit in the economy, which can have a direct effect on business and personal spending. Central banks use quantitative easing after they’ve exhausted conventional tools, such as lowering the interest rate.

It shrinks the Fed’s balance sheet by either selling Treasurys (government bonds) or letting them mature and removing them from its cash balances. This removes money from the economy and leads to higher interest rates. Quantitative tightening (QT) refers to monetary policies that contract, or reduce, the Federal Reserve System (Fed) balance sheet. https://bigbostrade.com/ In other words, the Fed (or any central bank) shrinks its monetary reserves by either selling Treasurys (government bonds) or letting them mature and removing them from its cash balances. To carry out this unconventional monetary policy, the Central Bank will buy government securities from commercial banks and other private financial institutions.

QE increases the price of financial assets other than bonds, such as shares. We are the UK’s central bank and our job is to get the rate of inflation to our 2% target. We do that by changing interest rates to influence what happens in the economy. Neo-Fisherism, based on theories made by Irving Fisher reasons that the solution to low inflation is not quantitative easing, but paradoxically to increase interest rates.

It may lead to currency appreciation, making exports less competitive, while increased foreign investment can pose challenges for monetary policy management. 3.) The central bank’s large-scale purchasing of securities often results in a country’s national debt growing substantially. Central banks use quantitative easing after they’ve exhausted conventional tools, such as lowering the interest rate. Lower interest rates are expansionary because they lower the cost of money and encourage economic growth, and higher interest rates are contractionary because they increase the cost of money and slow growth. Quantitative Easing aims to reinvigorate an economy grappling with sluggish growth. When conventional tools, like slashing short-term interest rates, seem insufficient or are already maxed out (think zero or negative rates), QE emerges as a potent alternative.

Reviewed by Subject Matter Experts

The Fed’s primary goal is to keep the U.S. economy operating at peak efficiency. Thus, its mandate is to enact policies that promote maximum employment while ensuring that inflationary forces are kept at bay. Inflation refers to the monetary phenomenon where the prices of goods and services in the economy rise over time. High levels of inflation erode consumer buying power and, if not addressed, could negatively affect economic growth. The Fed is very cognizant of this and tends to be quite proactive if it has evidence that this is happening. The Fed also took other steps such as backstopping money market mutual funds.

According to economic theory, increased spending leads to increased consumption, which increases the demand for goods and services, fosters job creation, and, ultimately, creates economic vitality. On May 4, 2022, the Fed announced that it would embark on QT in addition to raising the federal funds rate to thwart the nascent signs of accelerating inflationary forces. The Fed’s balance sheet had ballooned to almost $9 trillion due to its QE policies to combat the 2008 financial crisis and the COVID-19 pandemic. Knowing that supply would continue to increase through additional sales or the lack of government demand, potential bond buyers would require higher yields to buy these offerings.

What Is the Purchasing Managers’ Index PMI?

The genesis of the PMI lies in the need for timely indicators of economic conditions between the months when official government data is released. Back in the 1940s, leaders in the National Association of Purchasing Management, now called the Institute for Supply Management, recognized survey data that could provide crucial early signals of turns in the business cycle. They pioneered the first purchasing managers’ Index as a private metric to fill this information gap and help purchasing executives make better-informed decisions. Mr. Williamson is Chief Business Economist and an executive

director at S&P Global Market Intelligence. He is a well-known

economic commentator and is regularly quoted in international

business print and broadcast press, and frequently speaks at

conferences on global economic issues.

PMI is also considered a leading indicator because it tends to provide a glimpse of economic trends before they are reflected in other economic data. Changes in the PMI can signal shifts in economic activity before those changes are seen in other indicators like GDP growth or employment https://bigbostrade.com/ numbers. The PMI is usually released on a monthly basis, offering up-to-date information about the economic activity in the manufacturing or services sector. This timeliness allows policymakers, analysts, and investors to quickly assess the current economic conditions.

- Conversely, if it suggests overheating, they might tighten policy to curb inflation.

- These weighted figures are summed for each of the five key components, such as new orders, production, employment, supplier delivery times, and inventories.

- Regular 80% response rates safeguard consistency, elevating reliability versus informal collections vulnerable to biases.

- The services PMI™ was introduced in 1996 by S&P Global’s economists (known as NTC Research at the time) to accompany the existing manufacturing PMI.

- The PMI is likewise among the primary arrangements of economic indicators to be released every month, giving early hints on the state of the economy.

India’s services firms saw growth in new business and output accelerate to a 11-year high in June, as per the survey-based S&P Global India Services Purchasing Managers Index (PMI). If the index reading is higher than 50, then it indicates an economic expansion. This means that the closer the reading is to 100, the higher the degree of positive economic growth. A reading below 50 indicates an economic contraction, with readings closer to 0 indicating a higher degree of contraction.

Purchasing Managers Index (PMI)

P1 is the percentage number of responds that reported an improvement,

P2 is the percentage number of responds that reported no change in conditions,

P3 is the percentage number of responds that reported worse conditions. The Services PMI showed continued economic growth with a reading of 50.3% in May 2023. The ISM indicated that this was the fifth consecutive month of growth in this area. A parts supplier for a manufacturer follows the PMI to estimate the amount of future demand for its products.

Purchasing Managers’ Index (PMI) Definition and How It Works

However, we had warned that this upturn had been fuelled by surprising resilience of consumer-facing services and financial services. If the PMI moves lower in a given country, investors may want to consider reducing their exposure to the country’s equity markets. They can then increase exposure to other countries’ equities with growing PMI readings. It also helps to look at price-related data when analyzing the impact of potentially higher inflation on international bonds. In general, higher inflation readings mean that investors may want to reduce their exposure to the bond market, given the potential for lower prices. The purchasing managers’ index is published in different places, depending on the company and country.

Changes in new orders tend to precede changes in actual production by 1-3 months. Since new orders provide the earliest read on demand trends, this PMI component is useful for assessing the health of the overall economy. Growing new orders point to an expanding economy while declining new orders signal a potential economic downturn. Investors watch the new orders index closely as a leading indicator of economic momentum. A reading of 50 indicates that the manufacturing sector is at a standstill, with equal percentages of respondents reporting expansion and contraction.

The ISM Report on Business remembers surveys for manufacturing and non-manufacturing. Regularly enlisting approximately 80% response rates ensures accuracy over time. Questionnaires focus on factual changes to new orders, lead times, stockpiles, backlogs, and payrolls, relinquishing opinions for hard data. Respondents characterize fluctuations since the last period as elevated, steady, or diminished while elucidating seasonal influences.

What is the formula for the purchasing manager’s Index?

The Purchasing Managers’ Index, commonly referred to as PMI, is a monthly survey that provides insight into the health of the manufacturing sector. PMI are surveyed about key business metrics like production levels, new orders, employment, supplier delivery times, and inventories. Their responses are used to construct a diffusion index that summarizes economic conditions in the broader industrial economy. As professionals positioned early in the supply chain, purchasing managers feel changes in demand and activity before they are reflected in official output data. The PMI is based on monthly surveys of purchasing managers at companies in the manufacturing sector, who are asked about variables like production levels, new orders, supplier deliveries, inventories, and employment levels. The purchasing managers’ index is a major month to month economic indicator that spotlights on the performance of the manufacturing sector.

IHS Markit has conducted the survey and published the PMI report each month since January 1992, making it one of the longest-running economic indicators for the UK economy. The report provides critical insights into the state of British manufacturing. The purchasing managers’ Index, commonly referred to as PMI, is a survey-based measure of private sector business conditions in the manufacturing automated trading sector. The Purchasing Managers’ Index provides insight into business sentiment and economic health by aggregating qualitative data from surveys of purchasing and supply executives at manufacturing firms. Respondents are asked five questions, which are used to compile the headline PMI number, with any reading above 50 indicating expansion and below 50 indicating contraction.

PMI is the headline indicator in the ISM Manufacturing “Report on Business,” an influential monthly survey of purchasing and supply executives across the United States. The acronym PMI stood for Purchasing Managers’ Index prior to September 1, 2001. In case we are referring to manufacturing PMI for Germany, then traders would sell EUR/USD pair (selling the euro and buying the US dollar, as we have already discussed). Global demand for manufactured goods has suffered as central banks around the world have raised interest rates to battle decades-high rates of inflation. Price pressures have eased in recent months, but demand has yet to rebound to pre-pandemic levels. That has ramifications across the region since supply chains linked to China are scattered across many Asian countries.

This allows the Index to act as a single statistic that conveys the direction and magnitude of change detected across the manufacturing economy from one month to the next. Questions ask firm representatives about new orders, production, employment, supplier deliveries, and inventories. Yes, the Purchasing Managers’ Index is considered a leading economic indicator. As a monthly survey of procurement managers upstream in supply chains, the PMI detects fluctuations permeating industries before they appear in other lagging reports.

These seasonal adjustments are made to adjust for the effects of recurring intra-year deviations due to normal differences in weather conditions, holidays etc. Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest. The business activity index for the construction industry, included as part of the non-manufacturing PMI, stood at 53.9 a decrease of 3.0 percentage points.

Bail out Idioms by The Free Dictionary

Debates raged in 2008 over if and how to bail out the failing auto industry in the United States. Those against it, like pro-free market radio personality Hugh Hewitt, saw the bailout as unacceptable. Furthermore, government bailouts are criticized as corporate welfare, which encourages corporate irresponsibility. A bailout occurs when a third party – usually a government or government agency – steps in to save a company or companies by providing them with capital, credit, and other forms of support. A bailout is usually initiated when the consequences of allowing the company or companies to fail would lead to contagion and create even greater systemic risk. In addition to the government, other corporations, private individuals, or non-profit organizations may also get involved.

- All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only.

- Simultaneously, the public found it difficult to get financing, including auto loans, during the financial crisis as banks tightened their lending requirements, further hampering auto sales.

- These conditions are intended to ensure that the company is able to become financially stable and avoid the need for future bailouts.

Automakers such as Chrysler and General Motors (GM) were also knocked down during the 2008 financial crisis. The automakers sought a taxpayer bailout as well, arguing that, without one, they would not be able to stay solvent. In 2010, Ireland bailed out the Anglo-Irish Bank Corporation to the tune of €29.3 billion. Greece received European Union (EU) bailouts which topped the scale at around €326 billion. Other rescues include South Korea in 1997, Indonesia in 1999, Brazil in 1998, 2001, and 2002, and Argentina in 2000 and 2001. Overall, while allowing a company to fail may be a necessary and unavoidable outcome in some cases, it is generally seen as a last resort and is often avoided through bailouts or other forms of financial support.

These actions help to prevent the consequences of that business’s potential downfall which may include bankruptcy and default on its financial obligations. The Irish banking crisis of 2008 has similarities to other banking crisis, but it was unique in that it was the first banking crisis in a country that was a member of the eurozone. That made the Irish government and central bank have unique constraints when the crisis struck.[64] The post-2008 Irish economic downturn was also unusually steep. The impact on Irish government credit was so severe that it was forced to seek assistance from the European Union and the IMF. Automakers were under pressure as slumping sales plunged amid the dual impacts of surging gas prices and an inability for many consumers to get auto loans.

Bailouts may also come with certain strings attached, such as limitations on executive compensation, debt limits, or increased oversight and accountability measures. These conditions are intended to ensure that the company is able to become financially stable and avoid the need for future bailouts. The risks of a bailout include the possibility of moral hazard, where companies may become reckless and take on too much risk knowing that they will be bailed out if they do fail. Another risk is the cost to taxpayers or other investors who may have to foot the bill for the bailout without seeing much upside. The benefits of a bailout are that it can prevent the collapse of a company or organization and its industry, preserve jobs, and maintain economic stability. This is especially true if a company’s collapse will have ripple effects that can bring about even more corporate failures.

This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. The FDIC has drawn attention to the problem of post-resolution governance and suggested that a new CEO and Board of Directors should be installed under FDIC receivership guidance. In the United Kingdom, the bank rescue package was even larger, totaling some £500bn.

Scrabble Words Without Any Vowels

Bailouts are typically only for companies or industries whose bankruptcies may have a severe adverse impact on the economy, not just a particular market sector. The cross-border elements of the resolution of globally significant banking institutions (G-SIFIs) were a topic of a joint paper by the Federal Reserve and the Bank of England in 2012. Bear Stearns, which became one of the largest investment banks with $2 billion in profits in 2006, was acquired by JP Morgan Chase in 2008. These examples are programmatically compiled from various online sources to illustrate current usage of the word ‘bailout.’ Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. The EU is currently debating how best to implement the FSB requirements across its banking system and what the appropriate size of that requirement should be. Dating back to the 1580s, the term was used to describe the act of procuring a person’s release from prison by posting bail.

bail someone/something out

More specifically, the high prices at the pump caused sales of the manufacturers’ SUVs and larger vehicles to plummet. Simultaneously, the public found it difficult to get financing, including auto loans, during the financial crisis as banks tightened their lending requirements, further hampering auto sales. Financial institutions such as Countrywide, Lehman Brothers, and Bear Stearns failed, and the government responded with a massive assistance package. On Oct. 3, 2008, President George W. Bush signed into law the Emergency Economic Stabilization Act of 2008, which led to the creation of the Troubled Asset Relief Program (TARP).

bale out Business English

When a company accepts a bailout, it will often see its management team replaced and its debts restructured. The scope of the planned resolution regime was not limited to large domestic banks. The inclusion of FMIs in potential bail-ins is in itself a major departure. The FSB defines those market infrastructures to include multilateral securities and derivatives clearing and settlement systems and a whole host of exchange and transaction systems, such as payment systems, central securities depositories, and trade depositories. That would mean that an unsecured creditor claim to, for example, a clearing house institution or a stock exchange could in theory be affected if such an institution needed to be bailed in.

Also, it is essential to understand, many of the businesses which receive rescue funding will eventually go on to pay back the loans. However, AIG also received aid in ways other than merely financial, which is harder to track. Businesses and governments may receive a bailout which may take the form of a loan, the purchasing of bonds, stocks or cash infusions, and may require the recused party to reimburse the support, depending upon the terms. The bailout initially cost about 4% of Sweden’s GDP, later lowered to 0–2% of GDP, depending on the various assumptions if the value of stock that was sold when the nationalized banks were privatized. A form of bail-in was used in small Danish institutions (such as Amagerbanken) as early as 2011.[38] The Dutch authorities converted the junior debt of SNS REAAL in 2013, as part of a privately funded recapitalization. Also, with each new bailout, the record books are reopened, and a new biggest recipient award is updated.

bail out Intermediate English

TARP allowed for the United States Department of the Treasury to spend up to $700 billion to purchase toxic assets from the balance sheets of dozens of financial institutions. For example, a company that has a considerable workforce may receive a bailout because the economy could not sustain the substantial jump in unemployment that would occur if the business failed. Often, other companies will step in and acquire the failing business, known as a bailout takeover. In the late 1980s and the early 1990s, over 1000 thrift institutions failed as part of the savings and loan crisis. In response, the US established the Resolution Trust Corporation (RTC) in 1989. The terms of a bailout will vary on a case-by-case basis; however, there will usually be set conditions or requirements for receiving a bailout, such as a restructuring plan or changes to the company’s management and operations.

The U.S. government offered one of the most massive bailouts in history in 2008 in the wake of the global financial crisis. The rescue targeted the largest financial institutions in the world who experienced severe losses from the collapse of the subprime mortgage market and the resulting credit crisis. Banks, which had been providing an increasing number of mortgages to borrowers with low credit scores, https://1investing.in/ experienced massive loan losses as many people defaulted on their mortgages. The U.S. government has a long history of bailouts going back to the Panic of 1792. Further, the financial industry is not the only one to receive rescue funds throughout the years. Lockheed Aircraft Corporation (LMT), Chrysler, General Motors (GM), and the airline industry also received government and other bailout support.

bail out American Dictionary

Although they were still large, they were no longer too big to fail because of the improvements in resolution technology. While intended for financial companies, the two automakers ended up drawing roughly $63.5 billion from TARP to stay afloat. In June 2009, Chrysler, now Fiat-Chrysler (FCAU), and GM emerged from bankruptcy and remain among the larger auto bail out meaning producers today. A quite different, and rather more profound approach would be to deploy a super special resolution framework that permitted the authorities, on a rapid timetable, to haircut uninsured creditors in a going concern. A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy.

Ever since then, people have used the term ‘bail out’ to describe the literal or figurative act of coming to someone’s rescue – either physically, financially, or in some other way. Treasury has recouped $377 billion of the $443 billion it dispersed, and GM and Chrysler paid back their TARP loans years ahead of schedule. The U.S. Treasury ultimately wrote off approximately $66 billion, including stock losses. During the Panic of 1792, debt from the Revolutionary War led the government to bail out the 13 United States. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only.

A company may need a bailout if it is facing severe financial difficulties that threaten its survival, such as mounting debts, declining revenue, or a sudden downturn in the market. A bailout can provide the company with the necessary funds to continue operating, restructure its operations, and pay off its debts. Usually, a company would be bailed out only if allowing it to fail would have significant consequences for the wider economy. A bailout is when a business, an individual, or a government provides money and/or resources (also known as a capital injection) to a failing company.

Bad Debt Expense Journal Entry and Example

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Contrary to customers that default on receivables, debt tends to be a more serious matter, where the loss to the creditor is substantially greater in comparison. For companies that offer debt securities and lines of credit to consumers and corporate borrowers, defaults on financial obligations – akin to irretrievable receivables – are an inherent risk to their business model. The term bad debt could also be in reference to financial obligations such as loans that are deemed uncollectible. However, the odds of collecting the cash tend to be very low and the opportunity cost of attempting to retrieve the owed payment typically deters companies from chasing after the customer, especially if B2C.

- The journal entry for the direct write-off method is a debit to bad debt expense and a credit to accounts receivable.

- If the total net sales for the period is $100,000, the company establishes an allowance for doubtful accounts for $3,000 while simultaneously reporting $3,000 in bad debt expense.

- If a receivable appears on your statement of financial position that you no longer deem collectible, you must write it off.

- This would ensure that the company states its accounts receivable on the balance sheet at their cash realizable value.

Bad debt is the term used for any loans or outstanding balances that a business deems uncollectible. For businesses that provide loans and credit to customers, bad debt is normal and expected. The seller can charge the amount of the invoice to the allowance for doubtful accounts. The journal entry is a debit to the allowance for doubtful accounts and a credit to the accounts receivable account. Again, it may be necessary to debit the sales taxes payable account if sales taxes were charged on the original invoice.

When dealing with a moneylender, it’s critical that you pay off your bad debt as soon as you’re able. Personal loans such as credit cards have interest rates that fluctuate depending on your credit history, which looks at prior track records you have as a debtor. There are several different forms of bad debts to consider, including the following below. Much like other accounting methods, the direct write-off method is methodical and structured. A determination into which debts are problematic is made as a judgment by the accountant. There are various reasons why a corporation may be unable to collect a debt fully; these include payment disputes, bankruptcies, and even extending to clients who refuse to pay.

Bad debt can be reported on the financial statements using the direct write-off method or the allowance method. A customer has been invoiced 200 for goods and the business has decided the debt will not be paid and needs to post a bad debt write off. During 2014, Mr. David wrote off $9,200 as bad debt, specifically as amounts due from various debtors who either died or declared bankruptcy. Consider a retailer, UK Ltd., that has sold products worth £10,000 to a customer, PZ, on credit. In either case, bad debt represents a reduction in net income, so in many ways, bad debt has characteristics of both an expense and a loss account. In terms of accounting, the bad debt would be incorporated into the income statement.

Where the percentage of sales method is used regarding the income statement, the percentage of receivables method is used regarding the balance sheet. It’s beneficial for them to be able to close out a bad debt on their financial accounts since it shows a history of prompt payment recovery. Investors use these facts to evaluate a company’s profitability and reliability. After this, before these debts are written off, information is gathered on items such as historical precedents and the client’s credit score (in regard to account receivables payment). Accounts receivable are considered bad debt if the firm believes and has demonstrated past historical records that it will be unable to collect payment from the specific client.

Because no significant period of time has passed since the sale, a company does not know which exact accounts receivable will be paid and which will default. So, an allowance for doubtful accounts is established based on an anticipated, estimated figure. Because the company may not actually https://1investing.in/ receive all accounts receivable amounts, Accounting rules requires a company to estimate the amount it may not be able to collect. This amount must then be recorded as a reduction against net income because, even though revenue had been booked, it never materialized into cash.

Therefore, the total debit to Year 2015’s profit and loss account in respect of bad debts would be $1,320 (written off as bad debts) plus $5,500 (increase in provisions for bad debts), amounting to $6,820. Bad debt is basically an expense for the company, recorded under the heading of sales and general administrative expenses. But the bad debt provision account is recorded as a contra-asset on the balance sheet. If the following accounting period results in net sales of $80,000, an additional $2,400 is reported in the allowance for doubtful accounts, and $2,400 is recorded in the second period in bad debt expense.

What is the difference between Bad Debts Expense and Allowance for Bad Debts?

Under the direct write-off method, the company records the journal entry for bad debt expense by debiting bad debt expense and crediting accounts receivable. In the online course Financial Accounting, it’s explained that one strategy is to overestimate bad debt provision. This is a more conservative provision strategy and can be helpful in times of unexpected crisis. If your company’s bad debt exceeds the original estimate, you’ll be required to list it as a bad debt expense on your income statement. By making a more conservative provision, your company can avoid having to pay those expenses. With the direct write-off method, the company usually record bad debt expenses in a different period of those revenues that they are related to.

Deals with moneylenders